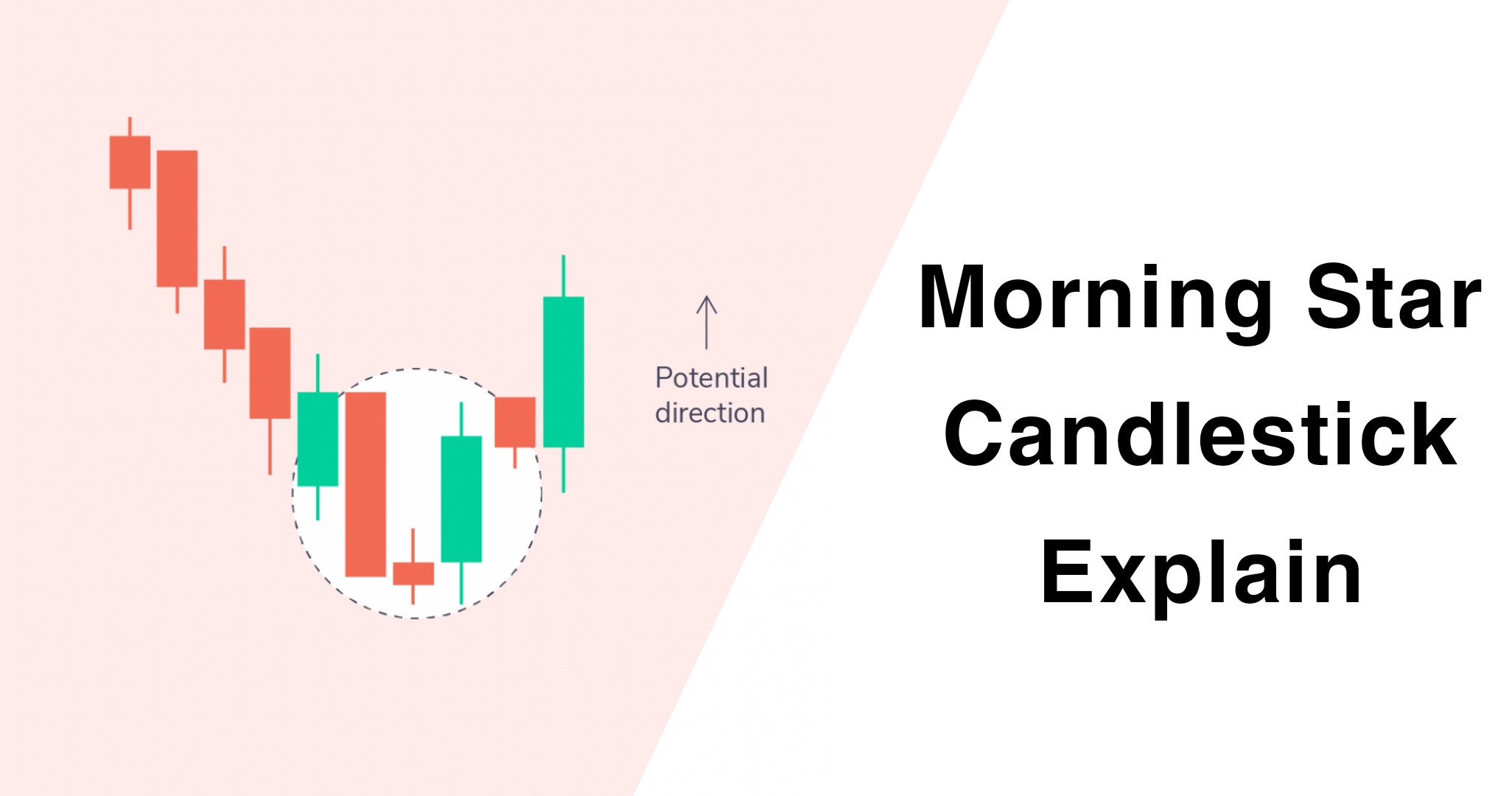

“The morning star candlestick pattern is a three-candlestick pattern that signifies bullish sentiment in the market and shows the potential reversal after a downtrend. The first is a bearish candle, the second is a small-bodied candle indicating indecision and the third one is a strong bullish candle that shows now change the bearish to bullish sentiment.“

So in this article, we understand how the Morning Star candlestick is formed and how we can make trading decisions with this pattern using technical analysis.

Introduction

The Morning Star candlestick pattern is a multiple candlestick pattern, Most of the traders use Morning Star candlesticks in their trading as a strategy to identify potential buying opportunities or as a powerful indicator of potential trend reversals in financial markets, as it suggests that sellers may be losing momentum and buyers are starting to take control. The Morning Star is treated as a bullish reversal, but only when it appears under certain conditions. So in this article, we discuss all the important points and master this pattern.

What is Morning Star Candlestick Pattern?

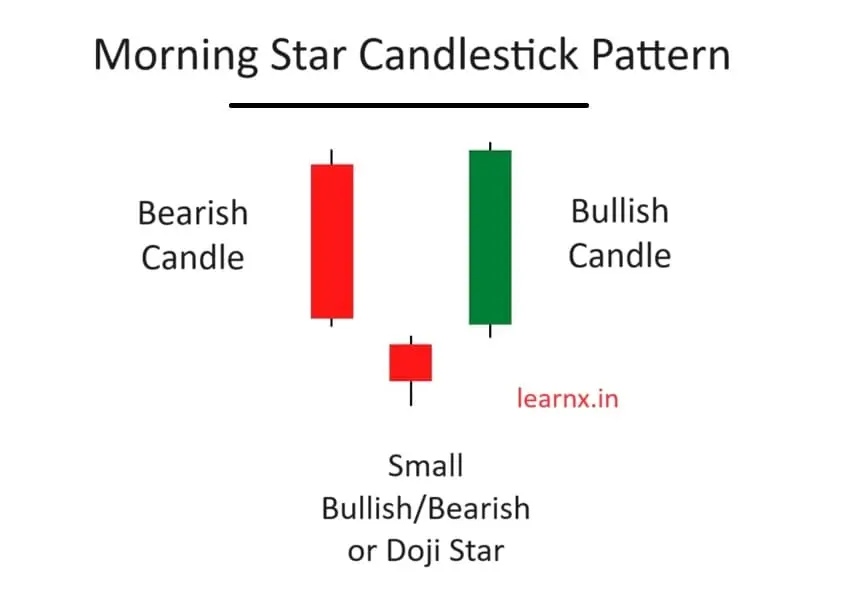

The morning star candlestick pattern consists of three candles, the first is a bearish candle, the second is a small-bodied or doji candle indicating indecision, and the third one is a strong bullish candle just you can see this image formation of the morning star.

First Candle (Bearish Candlestick): This represents a continuation of the existing downtrend.

Second Candle (Small-bodied or Doji Candlestick): This candle can be bullish or bearish but small body indicates indecision in the market. This suggests a potential weakness of the downtrend and also shows that supply and demand are equal, and the bears and the bulls are fighting in a control situation.

Third Candle (Bullish Candlestick): This candle opens and closes higher than the close of the second candle It signifies a potential trend reversal, as a sudden buying pressure has increased, Showing bullish sentiment.

The bullish engulfing candlestick has formed after a downtrend.

If volume data is available in charts, reliability is also more enhanced if the volume on the first candlestick is below average or low and the volume on the third candlestick is above average so this is a powerful indication of reversal.

To get a clear idea about the Morning Star candlestick pattern and what it looks like, please Refer to all the Images in this article with practical knowledge.

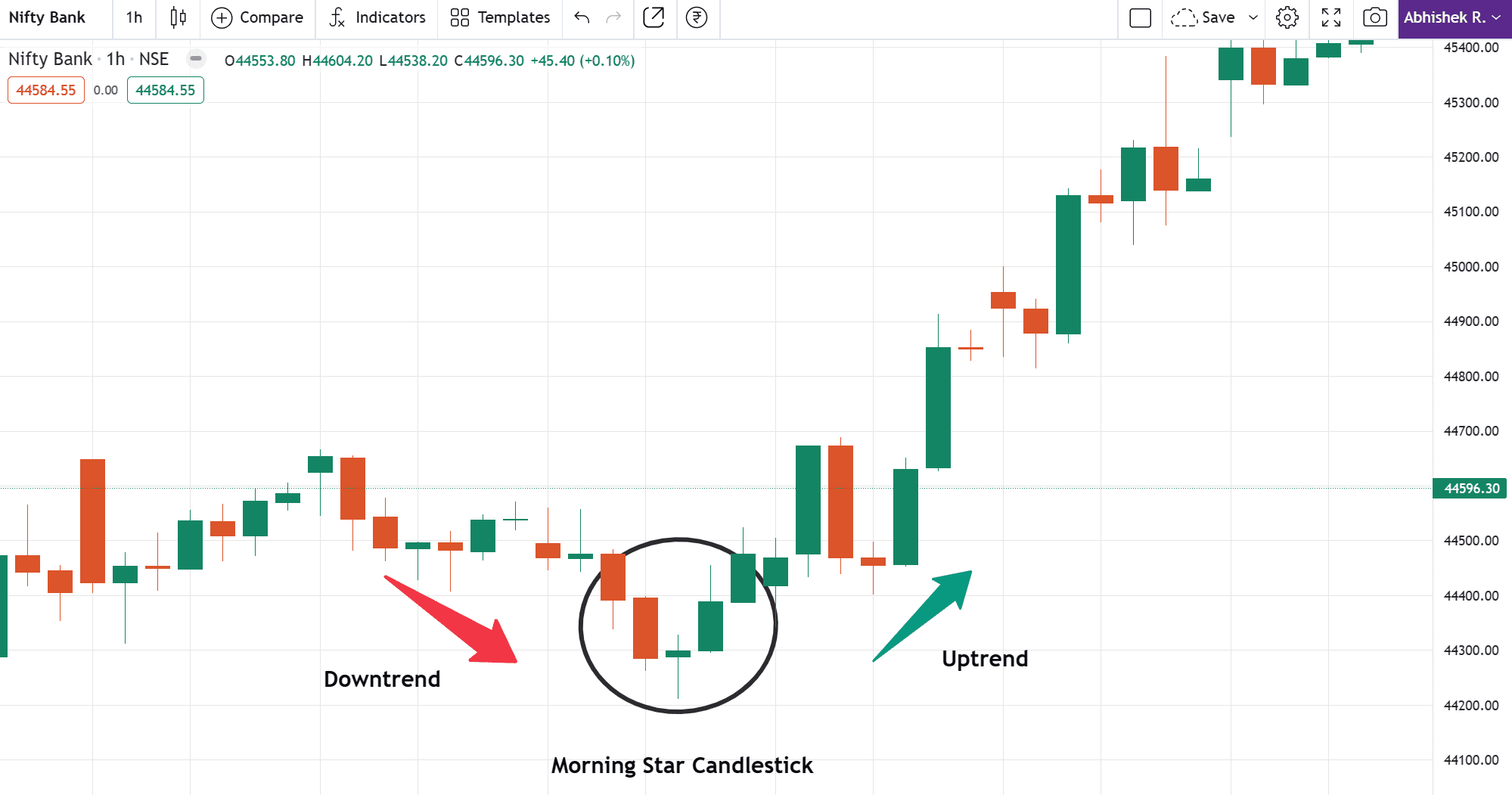

Understanding Morning Star Candlestick Pattern with Example

When identifying the morning star pattern, you should note the following points:

How to identify:

- First, find a clear downtrend in the market.

- At the bottom of the downtrend, there should be a small candle with a new low.

- The First and Third candles are bullish and bearish respectively.

- Note – The first candle is bearish or red the second one is small or doji & Third candle is a strong bullish Candle.

Morningstar Candlestick Trade Guide

Traders should enter long positions only after the confirmation of the third candle closing above the previous candle and it completely showing rising pressure. Now, a stop-loss can be placed at the low of the second candle or the new low of this downtrend.

A Morning Star candlestick pattern is a bullish reversal signal characterized by three candles, just shown in the examples, The Morning Star candlestick pattern indicates potential upward price movement. As per our experience when you master it you get approximately 80% accuracy.

Note: The stop loss can be placed below the recent swing low which is the low of the Second Candle.

The target limit can be placed at a key level that the price has bounced off previously or a horizontal resistance, So you can find the probability it results in a positive risk-to-reward ratio.

Moreover, if the Third candle is huge and long, it can practically close the door for you to open a new trade because sometimes your risk reward not match your trading style so you can avoid it, if you master then go for it with learnings.

It is simple to recognize the Morning Star Candlestick patterns just you can see this image, once you are familiar with them, this pattern offers traders good risk-to-reward ratios.

Morning Star Candlestick Trading Strategy Guide

- Image 1: Identify Morning Star Pattern Correctly.

- Image 2: Horizontal Support + Morning Star Candlestick Strategy.

- Image 3: Technical Analysis of Morning Star Candlestick [ Improved ]

Limitations

While the Morning Star candlestick pattern is a useful tool for indicating price movement for all traders as well as investors, but it’s essential to be aware of its limitations. One major key drawback is that it doesn’t guarantee a trend reversal.

False signals can cause a heavy loss so don’t trade blindly.

Market conditions and other factors should be important to consider for analysis. Like any tool, it’s not foolproof.

In simple language, while morning star candlesticks can be helpful, they’re not a magic solution. They have limitations if you use these limitations in your trading journey you can protect your capital from critical decisions.

Difference Between Morning Star Candlestick and Evening Star Pattern

Evening Star is completely opposite to Morning Star, Evening Star indicating a potential shift from an uptrend to a downtrend. Both patterns are crucial or useful for traders to recognize trend reversals and make informed decisions. here are the key points,

| Morning Star Pattern | Evening Star Pattern |

|---|---|

| The Bullish Reversal Pattern. | The Bearish Reversal Pattern. |

| Three Candle Pattern | Three Candle Pattern Completely opposite like Morning Star |

| This pattern shows in the downtrend. | This pattern shows in the uptrend. |

| Rules: The first Candle must be bearish, the Second Candle must be a short or doji star candle, Third is a Strong bullish candle close above the first bearish candle. | Rules: The first Candle must be Bullish, The Second Candle must be a short or doji star candle, Third is a strong bearish candle closing below the first bullish candle. |

Also Read: Bullish Harami Candlestick Pattern Explained

Final Conclusion

In conclusion, the Morning Star candlestick pattern is a useful pattern for all the traders to read a chart, Its three-candle structure. However, traders should exercise and take caution. Considering its limitations and the need for additional analysis. However, it is not a guarantee of success but this candle shows the possibility/probability that the market has changed its direction.

Remember Trading carries inherent risks, and it’s important to trade responsibly and never risk more capital than you can afford to lose. Some people lose their capital without a proper plan execution and psychological issues, and they don’t handle their risk management in crucial situations.

Leave a comment below and share your thoughts with LearnOneX. Your feedback is most valuable!

FAQ (Frequently Asked Questions)

What does the morning star candle indicate?

Morning Star indicates a bullish reversal in the market, bulls are strong after downtrend ends.

Is a morning star bullish or bearish?

The morning star is a bullish pattern while Evening Star is a Bearish Pattern.

Is Morning Star good for trading?

Yes, Morning Star is absolutely good for trading because sometimes we don’t know where the market reverses so it is helpful for take a decision.