SGB Gold Bond: We know Gold is considered a valuable investment tool. Sovereign gold bonds, which we know as SGB bonds, provide a safe and convenient way for citizens of India to invest in gold through the government. In today’s blog post, we will look at all the information about what Sovereign Gold Bond is, its benefits, etc.

Table of Contents

What is SGB Bond? (Sovereign Gold Bond)

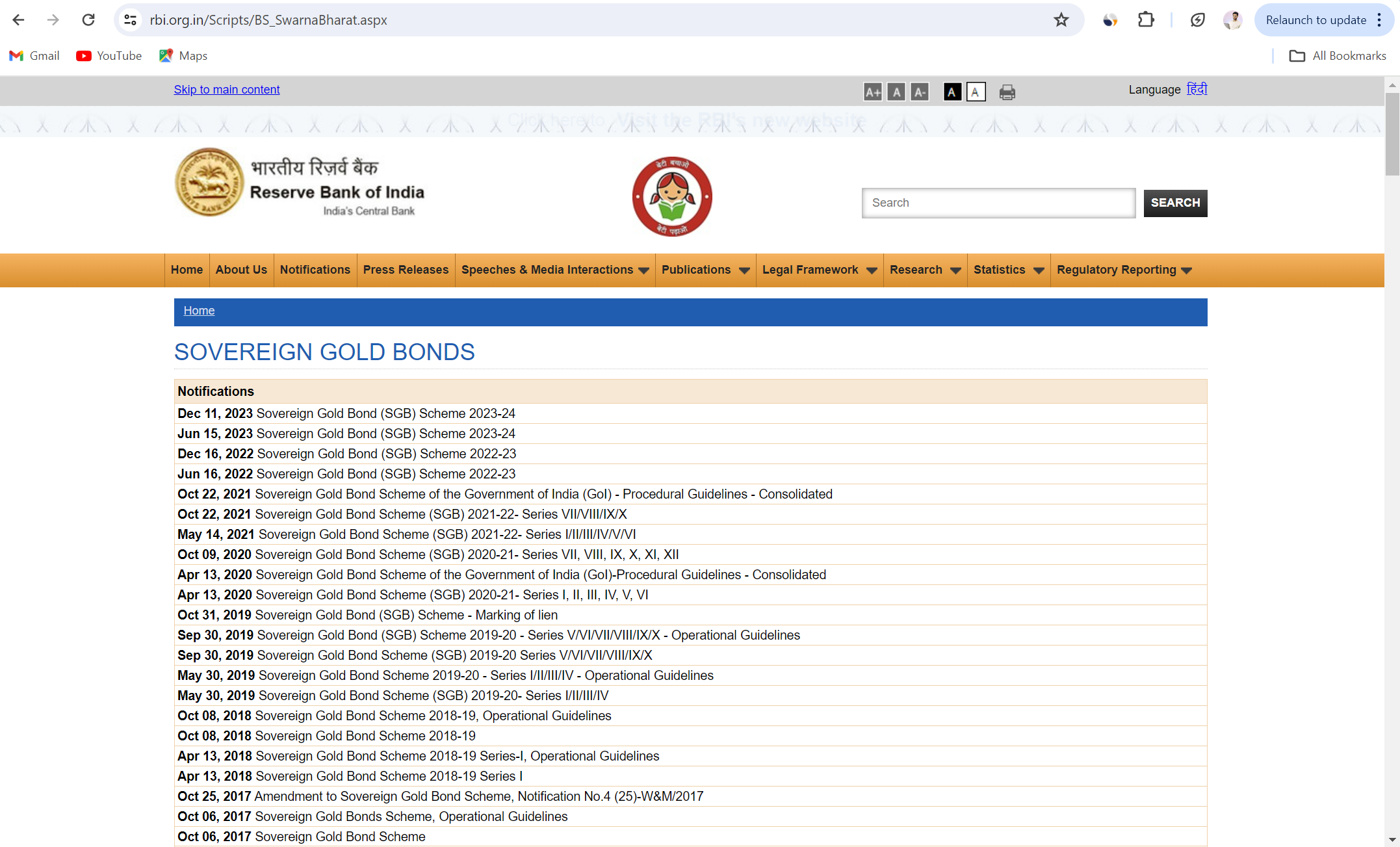

Sovereign Gold Bond is a government bond scheme issued by the Government of India, in this you can buy bonds of that denomination instead of actually buying gold. These bonds are issued by the Reserve Bank of India (RBI). In SGB, you get fixed additional 2.5% interest per annum, which is not available on any other investment in form of gold.

SGB is maintained by the Government of India i.e. RBI. Gold is measured by these bond instruments, i.e. your bond store in your demat account in virtual format.

Key points of SGB

- SGB is an important investment scheme run by the Government of India that is guaranteed by the RBI, so sovereign gold bonds are considered very safe.

- SGB bonds are for an average period of 8 years, but you can opt out after 5 years.

- The SGB bond gives annual interest, which is credited every six months. The interest rate is usually 2.50% on the current amount.

- When bond period ends (when your bond matures), you get a return similar to the market price in the gold market. That is, if the price of gold goes up, you get a higher return on your investment.

- The income earned from the bond is completely tax-free in form of capital gains.

- SGB bonds are available in digital form so we can track easily through Demat Account

- At least 1 gram of gold allowed be invested in SGB bonds. The investment limit is up to 4 kg for individuals and 20 kg for trusts.

How to invest in Sovereign Gold Bond

When government issue the new SGB bond series, then you can buy from national government banks, post offices and the official website of the RBI, along with you can easily buy it in your demat account in digital format through like popular apps groww, upstox and zerodha.

When you Invest in SGB you need to complete KYC by doing SGB Bond and submit necessary documents like your Aadhaar card and PAN card.

The minimum investment for SGB is 1 gram of gold. You can buy more gold according to your needs and budget.

In SGB Bond, you invest through mobile. In this you need active demat account.

For Regular updates visit official RBI Website

Risks of investing in SGB

The price of gold may fluctuate and your investment may also decrease. SGB bonds cannot be settle quickly and must be wait for a full period of time.

investing in SGB worth it?

If you are looking for a safe and secure way to invest gold in your portfolio, then SGB is a good option. but always remember before investing, fluctuations in the price of gold and the risks also associated with investing in SGB.

SGB bond gives you the benefit of gold value addition as well as regular annual interest, and you dont have to worry about storing gold its completely digital and secure by Indian government. So it can be a safe and profitable investment option for you.

Remember you should consult your financial advisor before investing in SGB bond scheme or you can visit the official website of RBI for more information: https://sovereigngoldbonds.rbi.org.in/

This is all about SGB Bonds if you like this information keep sharing with friend to educate financial products, for more investing blogs please visit LearnOneX

Also Read: Top 3 Green Energy Stocks under Rs 20

Keep Learning!