SIP investment (Systematic Investment Plan) The way of investing through mutual funds in which you can invest a certain amount in a mutual fund scheme after a certain period of time. In SIP you do not have to make such a lump sum investment once a month or once in three months, in which you have invest a certain amount in on the given date of every month.

In SIPs, you can invest at least amount of Rs 500 per month and it is similar to a periodic deposit. SIP directly connect your bank to debit a certain amount every month through (NACH) allows automatic payment every month, it is more convenient so that your investment is always done on time.

So in this blog post, we’re going to learn all about what is SIP investment and how it works, and its benefits.

Table of Contents

What is SIP?

Systematic Investment Plan known as SIP, which is a popular investment type in mutual funds in which you invest a certain amount in a regular basis of every month. Instead of investing in a lump sum, you can invest a little money in mutual funds per month.

SIP investment Example

Instead of investing money at the same time, we are investing a little money in it through SIP, which we will see in this example.

You can start Mutual Fund SIP just from Rs 500 onwards, SIP investors get benefit from the average cost of the rupee and the cyclical growth of markets.

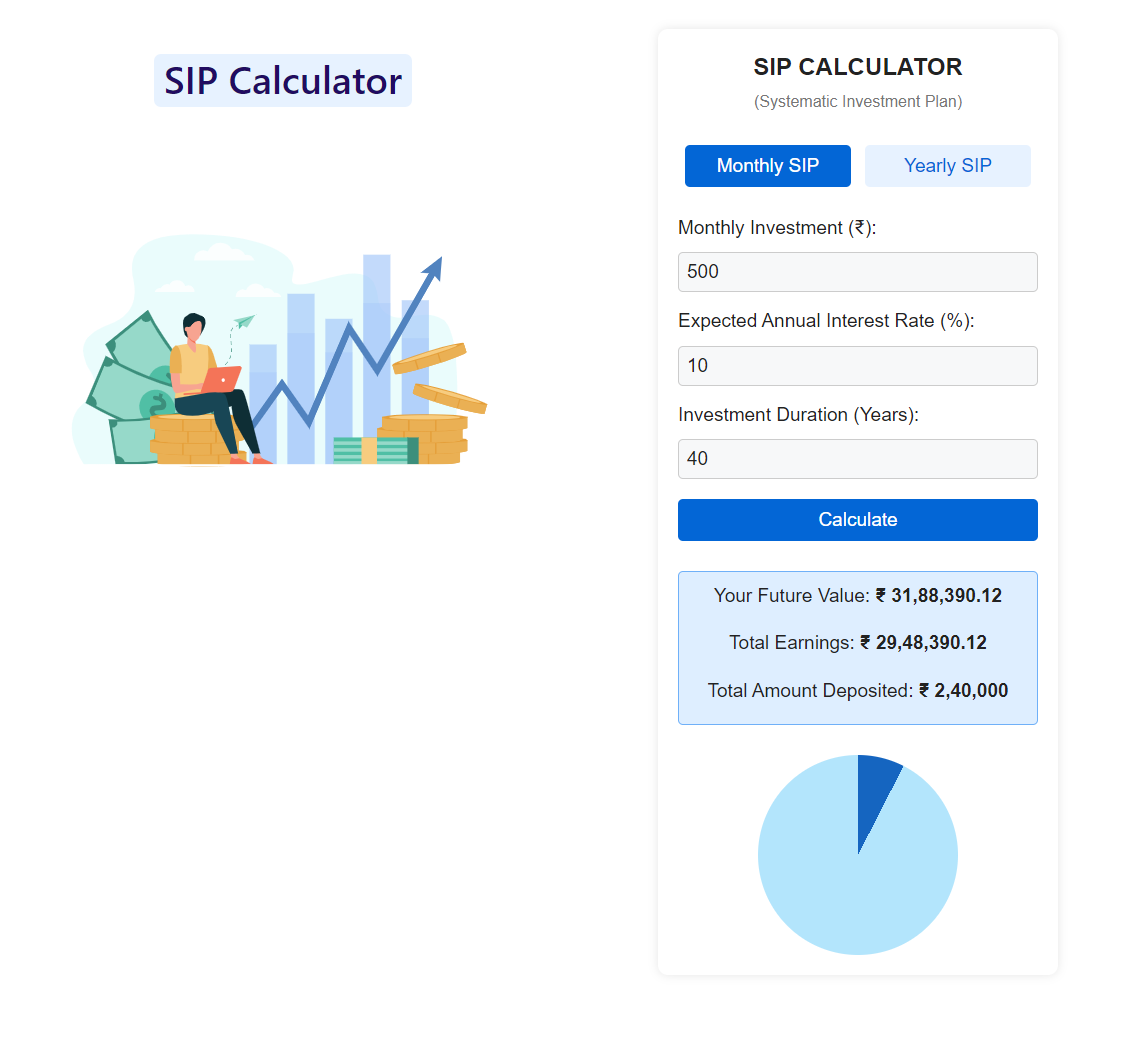

SIP investment Example – If you invest only Rs 500 per month for 40 years through SIP and if your fund gives an average 10% annual returns, you can get a total of Rs 31,88,400 after the 40 years. The returns can be more or less than this, you can see the full calculations of the following in which Rs 500 is invested for 40 years, then your total investment is 2,40,000 and you can get a huge benefit of Rs 29,28,390.

Calculate your SIP Returns as per your requirements using our Sip Calculator Online

Benefits of SIP

SIP investment allows you to invest regularly, which creates discipline in you financial wealth for the longest time.

You can start investments with a very small amount through SIP, such as Rs 500 per month, which makes it more profitable for new and small investors.

Through SIP, you can get the benefit of market volatility, In this you can buy mutual fund units at different prices which shows the benefit in the long term with cost cutting benefits.

In SIP investment, Compound interest works on your investment, which increases your wealth rapidly.

Investing in MF SIP is very easy. For investors, it is easy to use an online portal or mobile application to invest in SIP like Groww, Zerodha allows SIP investments.

Read: SGB Gold Bonds Explained

How to start investing in Mutual Fund SIP

Select Mutual Fund – Choose the right mutual fund according to your investment goals and risk. If you are going to invest in short term, invest in a Low Risk Mutual Fund but if you want to invest in Longterm then go with medium to high, try invest in Medium Risk because the more time you give your point, the more compounding returns you can get.

Choose the right SIP plan – In SIP investment choose the amount you want to invest in, i.e. how much you can invest (like how you can invest every month) and how long you want to invest. enter amount which you can invest every month without forgetting and select the plan accordingly.

Select Bank Account – Link your bank account and register that bank account with the mutual fund company.

NACH Automatic Payment Facility – This option may be suitable for you it offers direct automatic payment facility to your bank and mutual fund in which money from your bank account is invested in SIP on monthly.

Now you can start your MF SIP online or directly from your mutual fund company branch. The easiest way in this is you can invest through a registered app like Groww and Zerodha that provide all mutual funds investments schemes.

Final Words

SIP is fastest growing in Mutual Fund Scheme investors in India, as it allows you to invest minimally in a disciplined manner, without worrying about market fluctuations and market timing. SIP are the best way to invest in mutual funds for long term. Longterm investing is very important, that’s why you should start investing early which will give you more return in the end.

Remember, every investment involves some risks and SIP is no exception. Hence, diversify your portfolio with market fluctuations and stay go with long-term financial goals so that you can benefit from it.

Also Read: Mutual Fund Sahi hai Explain the SIP’s

Visit LearnOneX for more investing knowledge stuff….

Keep Learning Keep Sharing…

- About Us

- Calculate CAGR Returns CAGR Calculator (Compound Annual Growth Rate)

- Calculate Inflation Online – Inflation Calculator

- Calculate Lumpsum Returns

- Car Loan EMI Calculator

- Compound Interest Calculator

- Contact Us

- Currency Calculator

- EMI Calculator

- EMI Calculator

- FD Calculator

- Flat vs Reducing Rate Calculator

- Get instant personal loans upto ₹5 lakhs

- Goal Planning Lumpsum Calculator

- Gratuity Calculator

- GST Calculator

- Home Loan Calculator Online

- HRA Calculator

- Mutual Fund Returns Calculator

- NPS Calculator

- Online C++ Compiler

- Online Compiler

- Position Sizing Calculator

- PPF Calculator

- Privacy Policy

- Profit & Loss Calculator

- Profit and Loss Calculator

- Quadratic Formula Calculator

- Ratio Calculator

- RD Calculator

- Simple Interest Calculator

- SIP Calculator

- Step Up SIP

- Stock Heatmap Widget

- Stock Market Heatmap, live NSE Heatmap 360 Degree Market View

- SWP (Systematic Withdrawal Plan) Calculator

- Terms